pinellas county sales tax 2021

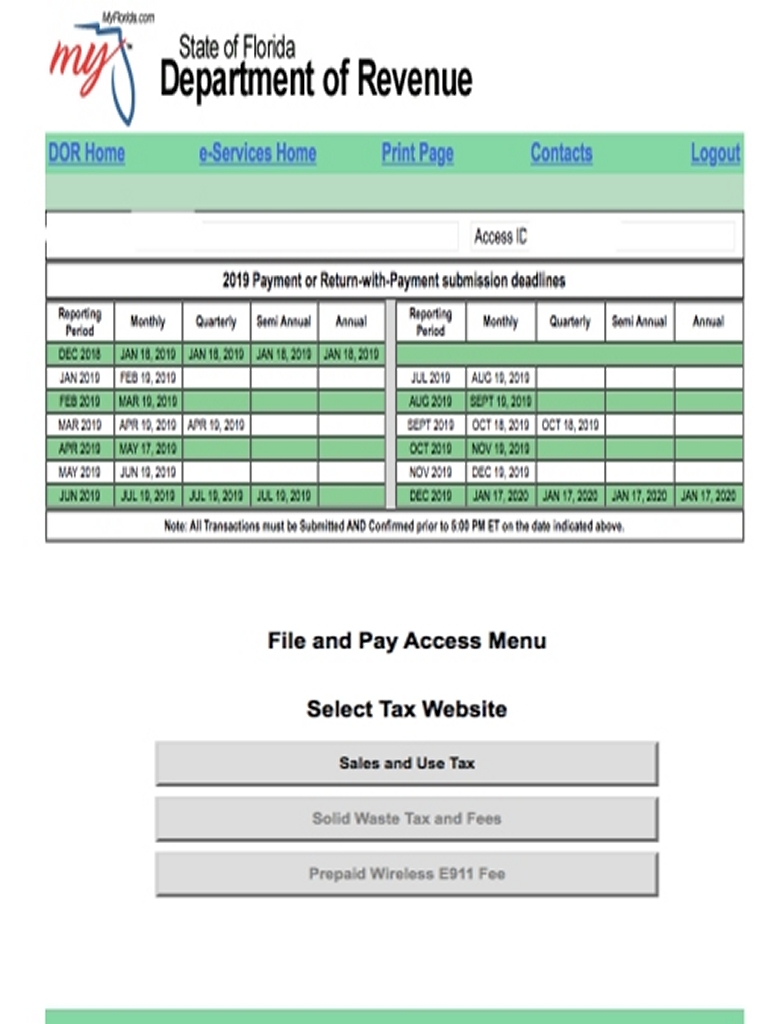

The Pinellas County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Pinellas County local sales taxesThe local sales tax consists of a 100 county sales tax. If there are no bidders the certificate is issued to.

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

Pinellas County in Florida has a tax rate of 7 for 2022 this includes the Florida Sales Tax Rate of 6 and Local Sales Tax Rates in Pinellas County totaling 1.

. 2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Pinellas Park Florida is. Just in time for the opening of Pinellas County schools on Aug.

2022 List of Florida Local Sales Tax Rates. ICalculator US Excellent Free Online Calculators for Personal and Business use. The latest sales tax rate for Palm Harbor FL.

Roads bridges and trails. Voted to approve this one-percent infrastructure sales tax. The Pinellas Park sales tax rate is.

3 Oversee property tax administration. Last updated April 2022. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

There was legislation to reduce the rate to 54 in 2021 however as part of the Covid-19 legislative package the state managed to pass delayed reduction in the commercial sales tax rental rate from 55 to 20. Did South Dakota v. Lowest sales tax 6 Highest sales tax 75 Florida Sales Tax.

Groceries are exempt from the Pinellas County and Florida state sales taxes. The December 2020 total local sales tax rate was also 7000. Higher maximum sales tax than 53 of counties nationwide.

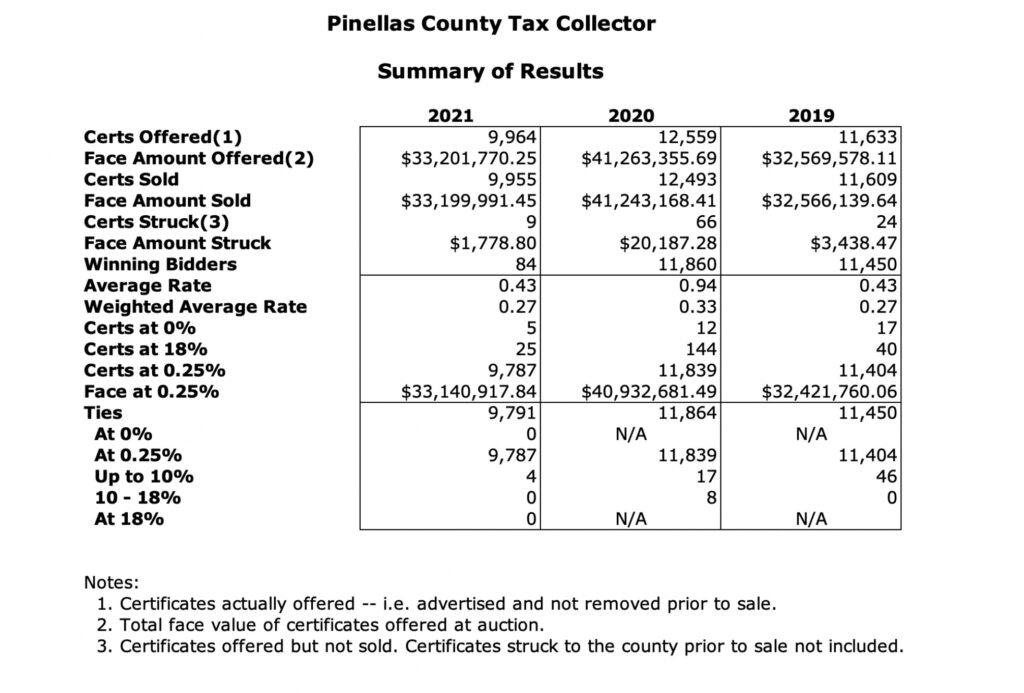

The sale is conducted in a reverse auction style with participants bidding downward on interest rates starting at 18. Pinellas County FL Sales Tax Rate. The sale allows investors to purchase certificates by paying the tax debt.

For further information call 727 464-3424. Click any locality for a full breakdown of local property taxes or visit our Florida sales tax. FL Sales Tax Rate.

72 rows For several years the state reduced the commercial rental sales tax rate small amounts with the latest reduction to 55 plus the local surtax effective January 1 2020. The Honorable Chairman and. Pinellas County keeps 2021 property tax rates the same and prepares for COVID-19 impacts County officials decreased expenditures and increased reserves in.

Pinellas County Florida A-7 FY22 Adopted Budget. Pinellas County Florida A-8 FY22 Adopted Budget. To be the Standard for Public Service in America.

2021 Pinellas County Government Accomplishments Our Vision. 2022 Florida Sales Tax By County Florida has 993 cities counties and special districts that collect a local sales tax in addition to the Florida state sales tax. The pinellas county sales tax is collected by the merchant on all qualifying sales made within pinellas county The current total local sales tax rate in pinellas county fl is 7000.

Depending on the type and location of your mobile home you may be required to register your home every year. The certificate is awarded to the bidder who will pay the taxes interest and costs and accept the lowest rate of interest. Water quality flood and.

Florida has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 15. October 1 2021 TO. Average Sales Tax With Local.

This rate includes any state county city and local sales taxes. The County sales tax rate is. This is the total of state county and city sales tax rates.

From 2018 to 2019 employment in Hillsborough County FL grew at a rate of 491 from 701k employees to 736k employees. 2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Heres how Pinellas Countys maximum sales tax rate of 75 compares to other counties around the United States.

To obtain accessible formats of this document please call 727 464-4062 VTDD. Consumers can purchase qualifying recreation and outdoor supplies and admissions to entertainment and cultural events exempt from tax during the Freedom Week Sales Tax Holiday which begins. Higher maximum sales tax than any other Florida counties.

There was legislation to reduce the rate to 54 in 2021 but the legislation was never enacted because the economic tsunami of Covid-19 started to hit while the legislation was pending. The Pinellas County Sales Tax is collected by the merchant on all qualifying sales made within Pinellas County. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually.

2021 Jul 29 2021 Updated Jul 31. Pinellas County complies with the Americans with Disabilities Act. The current total local sales tax rate in Pinellas County FL is 7000.

The Florida sales tax rate is currently. Registering your mobile home.

Tax Certificate And Tax Deed Sales Pinellas County Tax

Freedom Week Sales Tax Holiday Set For July 1 7 Pinellas County Tbnweekly Com

Brevard County Home Sales 2021 Statista

Millage Rates Pinellas County Tax

Discount Periods Pinellas County Tax

Florida Sales Tax Guide For Businesses

Get Ready Hurricane Season 2021 Prep For Pinellas Paradise News Magazine

Tax Certificate And Tax Deed Sales Propertyonion

Your Property Tax Bill Forward Pinellas

Archives For July 2021 Office Space Brokers

Florida Sales Tax Rates By City County 2022

Ways To Pay Pinellas County Tax

Florida S Back To School Tax Holiday Ends Monday

What Is Florida S Sales Tax Discover The Florida Sales Tax Rate For 67 Counties

2021 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

2022 Florida Sales Tax Rates For Commercial Tenants Winderweedle Haines Ward Woodman P A

Florida Sales Tax Returns Filings Our Florida Accounting Tax Advisers Team Can Help You Stay Current With All Your Florida Sales Tax Returns Filings